Bitcoin Price Predictions + BTC Price History Timeline Guide

Today’s Live Bitcoin Price: Real-Time BTC/USD Market Values

Where is the Price of Bitcoin Going? Over 50 Industry Movers and Shakers Weigh-In with BTC Forecasts

Ask anyone in the crypto world what their bitcoin price prediction is and they surely have a forecast, right?

While 2018 saw the price of Bitcoin stumble from its December 2017 all time high of $19,893 BTC/USD down to $3,131, it finally found a spark out of the 15-month ‘crypto-winter’ bear market in April 2019.

After soaring over $5,000+ on to a year-high of $13,387 according to CoinMarketCap (June), the number one cryptocurrency by market cap has been able to weather the doom and gloom storm by staying afloat hovering around the $8,000-$12,000 range to-date. But curious minds want to know, what’s next for $BTC?

MTC is grateful for dozens of credible crypto analysts, noted experts and prominent personalities who provided us with their futuristic bitcoin price insights. Examining the whole collection of BTC price predictions gets interesting when inquiring spectators start coming to the ever-evolving crypto industry.

After all, it costs nothing to give a formal forecast so the following is simply a fun to entertain best-of list. Without further ado, let’s jump right into the heart of the matter and sift through crypto community chatter.

This bitcoin price prediction overview is put together in four different sections:

- Over 50 $BTC price forecasts from crypto influencers, traders, analysts and die-hards

- bitcoin price history 2009 – 2019, year by year (see where BTC has been, to know where it is going)

- what influences the price of bitcoin; market volatility, supply/demand scarcity, value vs speculation)

- top 50 bitcoin price catalysts that could spark the next BTC/USD bull market run in 2019 and 2020

Top 50 Bitcoin Price Predictions: 2019, 2020-2024 Forecast List

After the most popular top BTC predictions list, be sure to research the bitcoin price history timeline of events and review the curated checklist of the top 50 bitcoin price catalysts all crypto enthusiasts should pay attention to in 2019. The 2020 bitcoin halving is also worth-while to see why many faithful bitcoin leaders can fathom the following foretelling forecasts. This catalogue of notable influencers’ will be continually updated as predictions are made public.

Let Master The Crypto know in the comments how your crystal ball matches up with these known bitcoiners; all the from crypto celebrities to BTC/USD experts to public trading analysts and even industry insiders, check out the 2019 list of prophetic Babe-Ruth like point-to-the-moon crypto calls.

Rank: 1

The following 2019 resource is a massive compendium of expert opinions/hot takes regarding what they think is in store for Bitcoin in the short and long term. The responses are quite varied in ranges, with some predicting BTC will scale above the $20,000 benchmark with ease in 2020 and other public figures believe the #1 coveted crypto coin can see a price point of $100,000 to $1 million within the next 10 years.

With that being said, it needs to be understood that even though the opinions of these experts are based on a host of quantitative data points, please acknowledge the inherent volatility of the bitcoin market and know these BTC/USD forecasts should not be taken as financial investment advice.

Take a genuine glance at the chronological timeline history of bitcoin’s price to see where it’s been to know where and why all of these cryptocurrency influencers are predicting such high BTC/USD values in the future.

1. Anthony ‘Pomp’ Pompliano (The Bitcoin Permabull)

The co-founder of Morgan Creek Capital is one of the most well-respected names when it comes to crypto-related advice (as is demonstrated by his 250k+ following on Twitter). In his opinion, all of the financial info associated with Bitcoin currently points to the fact that the currency will most likely scale up to a price point of around 50,000 US dollars by the end of 2022.

Some of the factors, in Pomp’s opinion, which seem to be greatly influencing BTCs price at the moment include:

- Parabolic increases in the value of Bitcoin that are taking time to stabilize.

- Bearish market conditions that seem to be creeping in time and again.

Lastly, it also bears mentioning that Mark Yusko, Pomp’s partner in crime at Morgan Creek too believes that Bitcoin could easily scale past the $75,000 mark by the end of 2020.

2. John McAfee (The Crypto Crusader)

The man, the myth, the legend. What can you say about John McAfee that hasn’t already been said? McAfee is a digital security pioneer who revolutionized how people protected their PCs and laptops back in the late ’90s and early 2000’s. Since then, he has forayed into the world of blockchain/crypto and has made many outlandish predictions regarding the price of Bitcoin.

For starters, he believes that BTC is on its way up to the $1 million mark by the end of 2020 — a prediction that sounds quite silly at first but when you consider the relative accuracy of McAfee’s previous claims, one is given to at least hearing the man out. In this regard, it should be pointed out that back in 2016 and 2017, John unequivocally stated that big things were in store for Bitcoin and that the flagship crypto would soon be worth $5,000. Little did he know that by the end of 2017, Bitcoin would reach its all-time high value of USD 20,000 (approx).

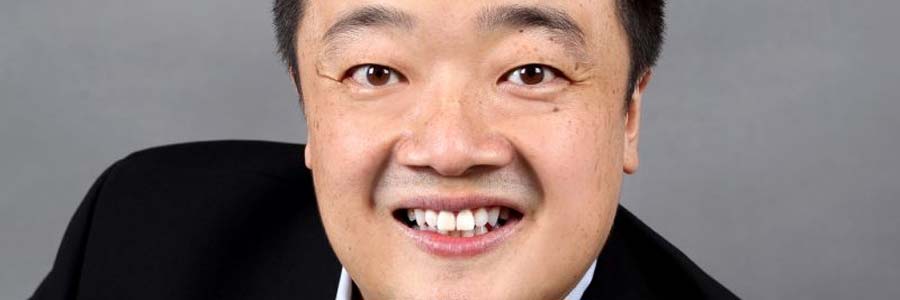

3. Jefferey LIU Xun (XanPool CEO)

Jefferey Xun, CEO of XanPool — an instant P2P fiat gateway that does not require custody — believes that in the short term, BTC will most likely to go down because of certain factors such as dwindling funding rates, contango, etc. He is also of the opinion that, in the near future, a number of other altcoin offerings will quite likely go down as well — a trend that has been quite visible over the past 12 months. In terms of the future of the altcoin market in general, Xun adds

“Altcoins will lose their market cap to some newer assets/ digital offerings coming into the market. Think about projects like Pokla, Eth 2.0 etc… essentially companies that hosted ICOs in 2017, and then and haven’t launched their product yet. When these products finally go live, they will gain dominance against a ton of existing alts, and perhaps even Bitcoin.”

4. Max Keiser

One of the earliest proponents of all things Bitcoin, Max Kiser has been talking about the premier digital currency since it’s market value lay at a meager price point of around $3. Additionally, he is also the host of a program called the ‘Keiser Report’ — a finance-oriented talk show that has time and again highlighted the advantages of crypto tech as well as exposed the biased inflationary policies of central banks all over the globe.

On the subject of Bitcoin’s monetary potential, Kaiser recently tweeted out that digital currency is all set to break past its previous ATH and climb up to around the $28,000 mark soon.

5. Trace Meyer

Veteran investor ‘Trace Meyer’ who has made a fortune for himself working within various traditional market sectors has been a major proponent of Bitcoin for a long time now. Meyer released his first pro-BTC blog back in 2011 — a time when the digital asset was trading for around $0.25 per token. Additionally, late last year, the maverick entrepreneur/ ardent defender of free speech released a tweet in which he claimed that using his uniquely crafted prediction algorithms, he was quite certain that the price of Bitcoin would reach $115,000 in the coming future.

6. Tom Lee

Fundstrat Global Founder Tom Lee is viewed by many from within the global finance community as being a perennial crypto bull. This is because Lee has frequently made bold claims about the future of various cryptocurrencies — with many of these predictions falling flat on their face. With that being said, it’s not as if Lee’s investment advice has not been on point many times in the past.

Speaking on the subject of BTCs future valuation recently, the Fundstrat CEO claimed that owing to the premier digital currency’s increasing mining costs, the price of a single token could quite easily scale up to around the $25,000 territory.

7. Bobby Lee

BTC Foundation board member and founder/CEO of BalletCrypto — Bobby Lee — is one of the few experts to have accurately predicted that Bitcoin would bottom out around the $3k mark sometime during early 2019. In this regard, Lee now believes that the flagship cryptocoin will experience a bull run during 2020 which will help push its price in an upward direction quite rapidly. Not only that, but he also claims that by the end of 2021, BTC will hit a peak of $333,000 before crashing once more and dropping to around the $40,000 mark.

8. Andy Hoffman

Hoffman is a crypto consultant as well as the CEO of Coingoldcentral. Additionally, between 2011-2017 he worked as the Marketing Director of a major, well-respected bullion dealer, Miles Franklin. Elaborating on his views regarding the future of Bitcoin, he told MasterTheCrypto:

“It is estimated that the global bond market is currently valued just over $100 trillion, 15% of which is negative-yielding – whilst total fiat currency outstanding is $90 trillion, total stock market capitalization $80 trillion, and the market cap of all the gold ever mined $9 trillion. Bitcoin is a far superior store-of-value asset than gold, so I expect it to one day be worth more than gold. As well, it could over time usurp some of the functions of legacy assets, making it worth significantly more. Thus, my “conservative” estimate is that within five years, it will be worth at least $5 trillion, or more than $250,000/BTC.”

9. Russell Okung

Seeing NFL star Russell Okung’s name along with those of seasoned crypto players such as Trace Meyer and Bobby Lee may seem quite funny at first, however, the Los Angeles Chargers left tackle has been one of the most vocal backers of Bitcoin over the past year or so. For starters, he lodged an official request with the NFL to allow players to receive their payments in crypto (if they so wished to do so). Not only that, but he has also been able to convince other established sporting big-wigs such as Buffalo Bills’ Quarterback Matt Barkley to join the crypto freight train.

Earlier this month, Okung hosted a Bitcoin (BTC) conference in Los Angeles to spread awareness about cryptocurrencies in general. The event was attended by the who’s who of crypto including:

- Bitcoin developer Jimmy Song

- Anthony Pompliano

- Crypto investor and podcaster Peter McCormack.

10. David Drake

Drake, who is the founder of LDJ Capital, believes that as awareness regarding crypto continues to grow, it would not be surprising to see Bitcoin become increasingly more expensive. In this regard, he believes that by the end of the year, BTC will rise to a price point of around $30,000. Not only that, his optimism seems to permeate beyond Bitcoin into a host of other altcoins – who he believes will play an ever-increasing role in the day-to-day life of the global economic sector.

11. Jeet Singh

Indian-American business entrepreneur Jeet Singh is probably best known for being the co-founder of Art Technology Group – a venture that pioneered the use of software and other digital tech mediums within the e-commerce market during the early ’90s. The project was extremely successful and thrust Singh and his partner Joseph Chung front and center of the global finance stage.

In Singh’s estimation, Bitcoin will most likely suffer from a period of volatility in the short term – which will cause the premier digital asset to float around the 10k mark for quite some time. Following this period, he believes the asset will scale up beyond $50,000 threshold. Lastly, it also bears mentioning that over the last six years, Singh has been working exclusively as a cryptocurrency portfolio manager.

12. Tim Draper

Founder of several established ventures such as Draper Associates and DFJ, Tim is widely considered to be the godfather of viral marketing – mainly because of his use of online mediums such as Skype, Hotmail, etc. Over the last 2-3 years, he has been a vociferous advocate of all things crypto and believes that the price of Bitcoin will most likely reach a mammoth price point of $250,000 by the end of 2022.

13. Vinny Lingham

Lingham, who is a board member of the BTC Foundation as well as the co-founder of Civic, believes that Bitcoin’s value is destined to keep rising and eventually go through several ‘boom and bust’ cycles. In this regard, he was quoted as saying:

“Bitcoin currently is priced at 2.5% chance of being worth $100k or .25% chance of being worth $1m.”.

Even though Lingham is highly optimistic about the price of Bitcoin, he doesn’t have a timeline as to when the premier crypto asset will begin its ascent and reach its destined financial heights. For starters, since BTC is both a scarce and valuable commodity, it’s value is bound to keep increasing. However, Lingham does concede that in order for the alt-currency’s value to soar, it needs to move from being just a digital commodity to becoming a store of value as well as a legitimate transaction medium.

14. Cameron Winklevoss

Cameron and his brother Tyler Winklevoss are responsible for establishing Gemini – one of the world’s most trusted cryptocurrency exchange platforms. In this regard, Cameran has been bullish on BTC (as well as a host of other digital assets) from the very start. Not only that, the brothers have served as some of the first mainstream proponents of this burgeoning asset class.

On the subject of Bitcoin’s future market potential, Cameron has stated time and again that because of the asset’s long term SOV properties, it has the potential to rapidly gain value and even reach a price point of $320k per token within the next couple of decades.

15. Kenneth Rogoff

The ex-chief of the IMF (International Monetary Fund) is not a big believer in the power of crypto. Essentially, he believes that owing to the use of Bitcoin for tax evasion and money laundering purposes, the crypto industry as a whole will have to face an increasing amount of heat from regulatory agencies all over the world – something that will eventually lead to the demise of the asset class completely. On the subject, Rogoff was quoted as saying:

“I think Bitcoin will be worth a tiny fraction of what it is now if we’re headed out 10 years from now… I would see $100 as being a lot more likely than $100,000 ten years from now.”

16. Bill Gates

The billionaire who has regularly featured in the list of the world’s most wealthy individuals has been a crypto hater since Bitcoin came to the forefront back in 2011. For example, a few years ago, Gates went on record to state that the asset class was a pure ‘greater fool theory’ type of investment. And while he hasn’t ever given an official price prediction for Bitcoin, he is quite sure that the asset will become worthless in the coming few years.

17. Joe Davis

Davis is a well-respected economist who believes that there is a good chance that Bitcoin’s price might to down to zero over the next few years. Additionally, he also points out that because BTCs price is merely based on speculation, it is subject to insane price swings.

Lastly, Davis – who is currently serving as the head of Vanguard’s investment strategy group – believes that people should only put their money in traditional investment vehicles that are known to provide their owners with definitive returns. Davis further says Bitcoin is a poor store of value, due to its volatility, and advises folks to only invest in tried-and-tested assets.

18. John Pfeffer

The Pfeffer Capital partner has time and again showcased his support for Bitcoin because he believes that the digital currency is one of the first viable assets to possess the power to completely replace gold.

Additionally, he has also mentioned in the past that if BTC does become a mainstream store-of-value, it would not be surprising to see the value of a single token surge past the $700,000 mark. To back up his assertions, he recently released some stats: Pfeffer stated that if BTC was somehow able to replace all of the world’s privately held gold bullion (estimated to be worth $1.6 trillion), the Bitcoin in circulation (at that given point in time) would become worth $90,000 apiece – a price point from where the premier digital currency would continue to increase in value.

19. Alexey Ermakov

Ermakov is the CEO of Aximetria, a mobile wallet and next-gen financial service for traditional and crypto-assets. In his estimation, Bitcoin will become one of the main means of preserving wealth as we move into the future — especially as people all over the globe transition to a digital way of conducting their finances. Additionally, he also believes that over time, cryptocurrencies (especially Bitcoin) will continue to gain momentum and flourish because of the simple fact that BTC is one of the few financial instruments that can easily be transferred across international borders without any restrictions.

In Ermakov’s estimation, it would not be surprising to see Bitcoin reach a price point of $70,000 in the coming few years.

20. Leonid Matveev

According to Matveev, the Head of Trending Analytics for Waves, many factors influence the cryptocurrency market at any given time — with one of the main ones being the real-world use of cryptocurrencies. However, owing to the flooding of this market in recent years, he believes that more than 95% of all current cryptocurrencies will be gone forever within the next 10 years. Matveev told MasterTheCrypto:

“To date, few currencies can compete with Bitcoin. Belief in the new technology of value transfer is confirmed by the relatively wide use of Bitcoin all over the world. Several factors serve as the driver of growth in the popularity of bitcoin.”

These factors include:

- Development of an infrastructural framework that allows users to exchange Bitcoin for fiat money.

- Growing needs of financial market participants in the diversification of risks. For example, new types of assets – such as Bitcoin – do not correlate with traditional securities, which makes investments safer.

- The global exchange of tax information is forcing people who want to keep their savings hidden, to look for other ways to escape.

21. Craig Russo

Craig is the founder of PEER, a Boston-based startup behind the popular crypto/gaming media outlet SludgeFeed. In this estimation, Bitcoin’s price will continue to outperform other alternative asset classes through the next few years. In the near-term (1-2 years), he says he wouldn’t be surprised to see BTC trading in the $20-30K range, taking out previous all-time highs. Not only that, but he also believes that with the influx of institutional dollars and more liquid futures products, the flagship cryptocurrency will begin seeing a reduction in its volatility — thus allowing the price of Bitcoin to witness more extended ranging behavior at these levels.

With that being said, Russo makes it abundantly clear that he is not one of those people who believes that a global economic downturn will be bullish for Bitcoin. In this regard, Russo told MasterTheCrypto:

“At the end of the day, Bitcoin has only existed in a risk-on macro environment and I simply don’t believe that investors will continue holding onto BTC if we see a crash in the equity markets.”

22. Michael Poutre

Michael Poutre is a well-respected industry leader who currently serves as a Managing Partner at Terraform Capital — an investment fund focusing on developing blockchain companies. Elucidating his thoughts on the future of Bitcoin, he told BEG that the fact that the premier digital asset has stabilized around the US$10,000 mark is proof enough that it is here to stay — a point that could have probably been argued just a few years ago. Furthermore, Poutre highlights the fact that governments around the world are starting to embrace the advantages of digital currencies, as a result of which Bitcoin is slowly being looked at by many as being ‘digital gold’ (as well as a good hedge option for the malaise du jour). In many instances, Bitcoin has proven to be a more effective hedge than gold. He further told MasterTheCrypto:

“While 17 million (or so) of the 21 million Bitcoins have been mined, there are factors to consider which can and should affect the price movement. The current price of Bitcoin reflects the market cap of all known mined coins, yet at some point, we will start pricing Bitcoin based on the ‘available float’ – and this could cause a generous increase in the price. Terraform believes that the price of Bitcoin will double from the current prices in the next 6 months, and we have a 24-month price target of US$50,000 per BTC.”

23. Nicholas Pelecanos

Pelecanos is one of NEM Ventures’ primary advisors and has been a part of the global crypto ecosystem from the very start. In his view, Bitcoin will witness several tangible price increases over its medium to long-term future because of certain factors such as:

- The net global debt volume reaching record highs.

- Technical indicators such as bond yield signaling an incoming financial crisis.

In Pelecanos’ opinion, the aforementioned factors alone paint a scary picture of what the future may hold. Thus, he believes that a majority of central banks and governments around the world can already see the incoming crisis and are aware that, unlike in 2008, they are in no position to bail out the banking system. He further told MasterTheCrypto:

“In the event of a banking crisis, Bail-in laws allow banks to freeze a portion of the savings from their users’ accounts and then credit their users with bank stock (which during a financial crisis will be shedding the majority of its value). When people become aware that their banked savings are not safe, I can see large capital in-flows into Bitcoin. If Bitcoin can attract just 5% of global household savings we would expect to see a 7x increase from today’s price or a $58,000 BTC. I can imagine negative interest rates would have a similar effect.”

24. Serena Williams

The global women’s tennis icon released a tweet a few months back stating that she has invested some of her life’s earnings in Bitcoin. Not only that, via an Instagram post earlier this year, the sports icon also revealed to her followers that she had secretly launched an investment company called ‘Serena Ventures’ back in in 2014 — through which she made investments in Coinbase. And while Serena hasn’t given an exact number as to how far the value of Bitcoin might increase in the future, her support in itself for the flagship cryptocoin shows that the currency is destined for great things in the future.

25. Ashton Kutcher

Actor and one-time model ‘Ashton Kutcher’ launched his very own venture capital firm — A-Grade Investments — nearly a decade back. As part of his professional pursuits, Kutcher put in an undisclosed sum of money into BitPay back in 2013. Not only that, the following year, he participated in a $12 million funding round for BitGo — a blockchain cybersecurity company.

In Kutcher’s opinion, crypto is an avenue that makes people feel safe about their wealth and Bitcoin, in particular, is an asset that has the potential to completely revamp how the global economic system works.

26. Murad Mahmudov

The host of ‘On the Record’ — a podcast that features some of the biggest names from the world of crypto — Murad believes that Bitcoin will scale up to it’s all-time-high within the next 12-16 months. Additionally, it bears mentioning that during one of his recent conversations with Tone Vays, he pointed out that Bitcoin was all set to surge past the $20,000 mark soon, a statement with which Vays agreed saying:

“There is a 40% chance that this happens next year.”

27. Jim Blasko

Blasko is the founder of Bitcoin Talk Radio and has been bullish on Bitcoin’s monetary prospects for nearly a decade now. As per this calculations, the digital asset’s future financial worth can stretch anywhere between $100,000 and $200,000 by the end of 2020 or early 2021. Elaborating on his stance a bit further, Blasko points out that due to Bitcoin’s mining reward being cut in half (from 12.5 Bitcoins per block mined to 6.25 Bitcoins) it would not be shocking to see more and more FOMO permeate the market gradually – thereby making the price of the digital currency soar to new heights.

28. Robin Singh

The Koinly.io founder believes that Bitcoin’s reach has been growing along with its price so there’s no reason to assume it will slow down in the long term. With that being said, he told MasterTheCrypto that the short term price of the asset depends heavily on whether projects like Libra make it into the public – and are received with the enthusiasm that matches all the hype currently surrounding this upcoming stable-coin offering.

Additionally, Singh also points out that interest from large companies will continue to play a big role in Bitcoin’s price increase in 2019 but the underwhelming launch of Bakkt only days ago has shown that not all of the hype surrounding this space should be believed – especially since BTC has dropped by over $2k since its launch.

“My price forecast for 2020 based on current market conditions would be around $8k. But then again BTC is volatile and if Libra is released the price could very well reach $15-20,000.”

29. Joe DiPasquale

In DiPasquale’s opinion, BTC’s price could range anywhere between $10,000 to $100,000 during the next 5 years. This is because he believes that the various fundamentals associated with the premier alt-currency are extremely likely to change as time goes on.

30. Matias Dorta

Founder of ICO Informer, Dorta believes that by the end of next year the price of Bitcoin will hover around the $30,000+ region. This is because he foresees several countries adopting the crypto-asset as a reserve currency before the end of the coming decade. Additionally, he also stated in an interview that as we move into the future, the “digital gold” narrative associated with Bitcoin will only continue to gain more and more traction.

31. Bobby Ullery

Ullery, the CTO of crypto firm Waysay, is a big supporter of premier digital assets such as Bitcoin and Ethereum. As per his calculations, the aforementioned currencies will share a $4.5 trillion market cap by 2020. Not only that, but Ullery also believes that by 2020 (a time when there will be approximately 18,375,000 BTC in circulation) the price of a single Bitcoin will rise to $61,900.

32. Fred Schebesta

Fred Schebesta is probably best known for being the co-Founder and CEO of Finder — a media outlet that has a decent presence within the world of crypto finance. He believes that Bitcoin’s price has the potential to explode by the end of 2020, however, for the time being, the currency will most likely continue to hover around the $10,000 region.

33. Fran Strajnar

Fran is probably best known for being the founder and CEO of crypto/blockchain firm Techemy Ltd. He has quite an optimistic outlook when it comes to BTC and believes that by the beginning of 2020, the flagship cryptocurrency will be able to break past the $200,000 mark. His estimates are based on the fact that the rate of BTCs adoption (which has been increasing quite rapidly over the past couple of years) is directly proportional to its price.

34. Sam Doctor

Fundstrat’s Quant Strategist Sam Doctor is a Bitcoin bull who believes that widespread crypto mining can lead to a reduction in the price of the BTC/USD pair while increasing the breakeven cost growth ratio of the premier digital currency. Additionally, as per a recent tweet by Doctor, he thinks that Bitcoin will close out the year at a price point of around $36,000.

35. Jack Dorsey

Jack Dorsey, the co-founder of Twitter, is a big supporter of Bitcoin — primarily because he owns a massive chunk of the flagship cryptocurrency himself. Additionally, he also has a stake in Lightning Labs — the venture responsible for creating/operating BTCs Lightning Network. In Dorsey’s own words, he is “extremely bullish” on the long term prospects of the BTC, with him going as far as saying that the crypto asset will one day become the single global currency of the world. However, he is not unrealistic in his approach and believes that such a global shift will take a minimum of 10 years to realize because we still don’t have the necessary technological capabilities needed to deploy Bitcoin as a daily transaction currency.

36. Roger Ver

One of the best-known crypto evangelists in the world, Ver has been pushing people to buy Bitcoin since the early half of 2011 — a time when the digital currency was being sold for a meager $10. To elaborate on how passionate Ver is about crypto, he has been making bold price bets concerning BTC for quite some time now. For example, in 2011 he bet a cool $10k on the fact that bitcoin would outperform gold, silver, the U.S. stock market, and the U.S. Dollar by a factor of 100 within the next two years. Ver’s prediction was off by a margin of just 60 days.

Also worth mentioning is the fact that Ver believes that Bitcoin Cash (BCH) is the real Bitcoin because it still adheres to the original vision of the premier digital coin. In this regard, he believes that BCH will eventually surpass BTC in terms of its price and will scale up to around the $250,000 region in the coming few years.

37. Ronnie Moas: $28,000

Respected analyst Ronnie Moas stated last year that Bitcoin’s financial future would pick up in 2019 — with the digital currency closing out the year at a price point of over $28,000. Late last year, he also pointed out that several institutions along with many of the world’s financial elites were trying to scare casual investors by manipulating the market big time.

38. Brandon Quittem

Independent crypto author/analyst Brandon Quittem believes that by the end of next year, Bitcoin will be worth approximately $75,000 – which is roughly about 10 times the price that the premier digital token is today.

39. Wences Casares: $1 Million

Bitcoin bull Wences Casares is also one of those dudes who believe that Bitcoin is headed to the 1 million dollar mark within the next 10 years or so. However, he made his bold claim at a time when BTC was surging and was close to it’s all-time-high value of 20,000 dollars. For those of our readers who might not be aware of who Casares is, he is an Argentinian entrepreneur who founded bitcoin wallet startup Xapo.

As per one of his recent interviews, he bought his first Bitcoin back in 2011 as a way to circumvent the volatility issues that were being faced by the Argentinian Peso. He also mentioned that many investors will soon be kicking themselves for not buying Bitcoin earlier — i.e. around a time when the currency was trading between $10,000 to $20,000.

40. Chamath Palihapitiya

Venture capitalist/ ex-Facebook employee Chamath Palihapitiya seems to agree with Casares and thinks that Bitcoin will be worth $1 million (within the next 20 odd years( and will scale up to around the $100k mark within the next 36-48 months. Palihapitiya has a lush history of making smart business moves — as is highlighted by his decision to become a part-owner of the Golden State Warriors, an NBA franchise that has made it to the finals 5 years in a row now. Not only that, his firm Social Capital currently has under its control more than $1.2 billion worth of customer funds. And while it is not clear as to how much BTC Palihapitiya currently owns, it is estimated that he possesses anywhere between 400,000 and 1 million bitcoin today. When asked why he is so bullish on bitcoin? Palihapitiya says that bitcoin is a “fantastic hedge and store of value against autocratic regimes and banking institutions”.

41. Kay Van-Petersen

Respected financial analyst Kay Van-Petersen has been affiliated with several big-name institutions such as ‘Saxo Bank’ over the past decade. However, he now specializes in crypto analytics and has gone on record to say that Bitcoin will be worth around $100,000 by 2028. In addition to this, he also believes that crypto will end up accounting for 10% of all daily currency trading volume in the future — eventually competing with many established fiat currencies. Lastly, it also bears mentioning that as per a study released by Unblock.net, Van-Petersen’s data seems to be mathematically valid.

42. Mike Novogratz

The former Goldman Sachs executive and founder of investment firm Galaxy Digital ‘Mike Novogratz’ predicted back in December 2018 that during 2019, Bitcoin’s value would gradually rise and close out the year on a high note. Not only that, but he also predicted that by the start of 2020, several established financial institutions would have entered this space — thereby allowing the price of various cryptocurrencies to soar.

43. Spencer Bogart

Blockchain Capital partner Spencer Bogart is a well-respected figure within many crypto circles because of his astute price predictions as well as mathematically sound analysis. This is best highlighted by the fact that he is regularly called to speak at many blockchain/crypto-related conferences around the world.

In terms of his BTC price outlook, Bogart spoke with Bloomberg earlier this year and stated that by the end of 2019, the price of Bitcoin would stabilize — following which it would once again start its upward financial ascent. Additionally, he also believes that owing to the efficacy/utility of the bitcoin network, the digital currency will gain more and more traction within the global finance arena.

44. Llew Classen

Bitcoin Foundation’s executive director Llew Clasen, previously said that by the end of 2018, the price of Bitcoin would reach a minimum of $40,000 — a prediction that fell short by quite a huge margin. Since then, Classen has remained fairly quiet and has refrained from giving any other predictions.

45. Sonny Singh

Bitpay CCO Sonny Singh recently said that he sees the price of Bitcoin scaling up to around the $20,000 by Thanksgiving 2019. To back up his claims, Singh has cited several factors such as:

- The launch of multiple crypto ETFs within this space.

- The increasing influx of money for various crypto-related startups over the last year or so.

46. Tai Lopez

Even though Lopez got into crypto quite late when compared to most of his contemporaries, the respected investor recently stated that if the global diaspora of millionaires were to allocate merely 1 percent of their holdings into bitcoin, the price of the flagship crypto-asset would rise to $60,000 within just 6-12 months. Similarly, in some other of his videos, he has gone on record to state that Bitcoin might become worth $1 million by 2024.

47. Zhao Dong

Zhao Dong is probably best known for being one of the largest over-the-counter (OTC) bitcoin traders in China. In the past, he has boldly claimed that a $50,000 price target for Bitcoin was not at all difficult and that the price of the premier asset would rise anywhere between 100% – 200% over the next three years.

48. Arthur Hayes

Arthur Hayes is a well-known industry figure — mainly because of his current role as the CEO of BitMEX. And while one would be tempted to believe that Hayes has an extremely bullish outlook towards the crypto market, in a recent interview he claimed that Bitcoin would experience record lows all through 2019.

49. Justin Sun

Justin Sun has become a major player within the global crypto ecosystem — with the TRON CEO even dishing out a huge sum of money to have dinner with legendary investment savant Warren Buffett recently. In terms of his predictions for Bitcoin, Sun stated in an interview earlier this year that the digital currency would trade anywhere between $3,000 and $5,000 for the entirety of 2019.

50. NAS

Nasir bin Olu Dara Jones — better known by his stage name NAS — is one of those venture capitalists whose name tends to fly under the radar because of his hip-hop associations. However, back in 2014, NAS launched a firm called QueensBridge Venture Partners (QBVP) through which he invested big in Bitfury. Not only that, as part of his VC pursuits, the rapper has also invested in many other companies including:

- Coinbase

- Robinhood

- Block Cypher

And even though he has refrained from giving any major price predictions in relation BTC recently, he is convinced that the flagship cryptocurrency will evolve into an independent sector of its own within the next 5-10 years.

51. Snoop Dogg

Everybody’s favorite rapper Snoop Dogg — who has previously gone by different aliases such as Snoop Lion, D.O.G.G, etc — is a big believer in Bitcoin. In the past, he has invested big in many different crypto ventures including altcoin exchange/ trading platform Robinhood along with other celebrities such as Jared Leto and Ashton Kutcher.

52. David Mondrus

Mondrus, who is the CEO Trive — a platform designed to weed out “fake news” from the internet — seems to agree with John McAfee and thinks bitcoin could very well reach a value point of $1 million within the next ten years or so. He believes that owing to an ever-increasing demand for BTC, the price of the digital asset will continue to rise exponentially.

53. Eric Wade of Crypto Capital

Eric Wade, long time crypto supporter who used to mine bitcoin, and now runs a cryptocurrency market newsletter in Crypto Capital, puts his 2020 BTC price prediction at $50,000 due to a simple formula. That is no change in fundamentals but a big increase in adoption and technology developments. He believes the bitcoin halving will be the spark plug and if BTC crosses $20,000, that the same bull panic FOMO of 2017 will kick in and shoot straight up to $50,000 a lot faster than you think.

Bitcoin Price Prediction Updates for 2019 and 2020

This growing list of bitcoin price predictions in 2019 for years 2020 and beyond will continue to evolve as more inquires get answered from top analysts and insightful community contributors. While it may be all in good fun to entertain these bold futuristic bitcoin value forecasts, please note all investments into $BTC are a gamble and one that must not be taken lightly considering any short term or long term play is not without reason.

Master The Crypto is very thankful to each of these individuals who shared their insights with us exclusively.

As the price of Bitcoin continues to get predictions from known individuals and industry insiders, we will update the list and hopefully have hundreds of curated $BTC to USD exchange rate value forecasts to share with you to see who and when people become right (for the fun of it). We hope you enjoyed this bitcoin price prediction review of the top $BTC value forecasts for 2019.

Now, let’s shift gears and think about all of the bitcoin predictions you just reviewed. There is a saying to note – if you want to know where something is going, know where it came from. In order to fully understand the visionary predictions about the future bitcoin price, let’s look into the bitcoin price history and compare where it came from in the past decade and where it is going in 2020 and beyond.

New 2019 Bitcoin Price Timeline Updates

Below is a list of the early pioneering days of the price action history of bitcoin’s value in US dollars. Here’s the latest updates from January to November 2019:

- October 26, 2019 – November 2019: the USD price of Bitcoin rebounded back to nearly $10,000, hovering in low $9,000s

- September 22 – October 25, 2019: BTC price went under $7,5000 after being above $10,000 during this phase

- August 6, 2019: manages to climb back over $12,000 for a week after slipping to under $9,500

- July 10, 2019: BTC/USD makes it back above $13,000 for the last time in 2019 so far

- June 26, 2019: Bitcoin all-time-high for 2019 of over $13,100+ before falling back to $9,800 on July 1

- June 22nd, 2019: bitcoin price nearly crosses $11,000 after being just $7,700 on June 9.

- May 14th, 2019: BTC/USD exchange rate value surpasses $8,000, the first time since July 28, 2018

- April 23rd, 2019: After months of bearish conditions, Bitcoin was finally able to leave behind its initial losses from May and scaled up to a five-month high of $5,600.

- March 31st, 2019: All through March, Bitcoin was able to slowly gather financial momentum — with the crypto asset closing the month on a positive margin of around $4,100.

- February 28th, 2019: Bitcoin’s price hovered below the $3,500 mark over the first week of February. However, soon thereafter the currency’s value started to rise and reached a price point of $3,867.

- January 31st, 2019: At the time, the CBOE — in conjunction with VanEck and SolidX — withdrew its proposal that sought to entail the creation of a Bitcoin ETF only to resubmit a couple of weeks later.

- January 1st, 2019: The year started rough for Bitcoin, with the premier digital currency staying below the $4k mark for a few weeks running. Even the overall capitalization of the crypto market stooped to around the $66 billion mark.

- December 3rd, 2018: For the first time in many months Bitcoin mining became an unprofitable activity. Not only that, only for the second time in its brief existence, BTC’s mining difficulty ratio dipped by a whopping 15% — thereby making way for a sharp depreciation in the currency’s total value.

- November 15th, 2018: Bitcoin Cash undergoes a hard-fork thereby facilitating the creation of Bitcoin ABC and Bitcoin SV — with the latter project being helmed by the notorious Dr. Craig S Wright, an Australian computer scientist who claims to be the pseudonymous inventor of Bitcoin, ‘Satoshi Nakamoto’. Additionally, owing to the fork, the price of Bitcoin dropped to $4,275.

- October 31st, 2018: The day marked the 10th birthday of Bitcoin’s Whitepaper causing the market to rise by a cool 5%.

- October 15th, 2018: Institutional custodian Fidelity announced the launch of its very own digital currency trading platform, as a result of which, the price of Bitcoin rose sharply.

- September 18th, 2018: Cryptocurrency Exchange, Zaif Falls gets scammed by hackers to a tune of more than $60 Million. Bitcoin’s price continues to hover around the $6k mark.

Bitcoin (BTC) Price History: List of Events Worth Noting

In order to know where bitcoin is going, it may be important to wonder where the price of BTC/USD has been before today.

Bitcoin Price in 2018

(i) Goldman Sachs Drops Plans to Launch Crypto Trading Desk (Sept 2018)

After sending the market abuzz with excitement, Goldman Sachs released a press statement claiming that the firm was dropping all plans of launching a Bitcoin-based trading desk anytime soon. This announcement came at a time when the market at large was struggling and the price was of Bitcoin was in freefall.

(ii) Bitcoin ETF Delayed by the US SEC (August 2018)

On the 7th of August, the US Securities and Exchange Commission released a statement in which the regulatory body made it abundantly clear that it was going to be delaying its decision on several Bitcoin ETF proposals that had been submitted to it.

(iii) Bakkt Launch Made Official by the Intercontinental Exchange (ICE) (August 2018)

A representative for ICE — the parent company of the New York Stock Exchange — released a statement on the 3rd of August stating that the financial juggernaut was going to launch a cryptocurrency startup known as Bakkt that would be supported by several established multinational firms including Microsoft, Starbucks, etc.

(iv) SEC Rejects ETF Proposal from The Winklevoss Twins for Second Time (July 2018)

For the second time within the space of a few months, the US SEC rejected an ETF proposal submitted by Tyler and Cameron Winklevoss — owners of the crypto trading platform ‘Gemini’.

(v) Blackrock Hints at Crypto Exploration (July 2018)

During the second half of July 2018, the CEO of Blackrock — one of the world’s largest wealth managers — announced his eagerness to examine the prospect of a crypto and/or Bitcoin-related fund.

(vi) Blanket Ban on Crypto Ads Reversed by Facebook (June 2018)

On the 23rd, Facebook announced that it was going to be lifting its ban on all crypto-related content which was announced during the first quarter of 2018. At the time, the price of Bitcoin was found floating around the $6,600 region.

(vi) Bithumb Falls Victim to Hacking Scandal — June 2018

The first few weeks of the month was pretty hard on Bitcoin, with the currency hovering around the $5,800 territory — thanks to South Korean crypto exchange ‘Bithumb’ being hacked by miscreants to the tune of more than $31 million.

(vii) Four Crypto Exchanges Brought to Court by the US CFTC (June 2018)

The United States Commodities and Futures Trading Commission filed several subpoenas on the 11th of June against Bitstamp, Kraken, ItBit, and Coinbase. In the court document, a representative for the CFTC pointed out that the aforementioned trading platforms had been indulging in different market manipulation tactics.

(viii) DOJ Launches Probe into Allegations of Widespread BTC Price Manipulation (May 2018)

US Department of Justice authorities launched an extensive criminal probe to assess whether certain financial entities were deliberately manipulating the price of Bitcoin for their personal gains. On the 24th of the month, the price of a single Bitcoin lay at $7,609

(viii) UpBit Headquarters Raided by Local Tax Agencies (May 2018)

On the 11th of May 2018, S.Korean tax officials raided UpBit’s office after they received word that the crypto exchange was manipulating its books. As a result of this news, the price of Bitcoin fell sharply 5.5% within a span of just a few days (from around $8,711to $8,372)

(ix) Goldman Sachs Announces its Plans to Explore Crypto Trading Solutions (May 2018)

A report released by the New York Times on the 3rd of May 2018, stated that finance giant Goldman Sachs was going to be exploring the prospect of launching its very own Bitcoin trading platform. The announcement sent the price of Bitcoin soaring above the $8,800 threshold.

(x) Twitter Bans Cryptocurrency Ads on its Platform — (March 2018)

In the wake of Facebook and Google deciding to ban all crypto-related ads on their respective platforms, Twitter too soon followed suit and did the same.

(xi) Google Bans Cryptocurrency Advertisements (March 2018)

During the first week of March, Google imposed a major ban on all ads related to crypto-assets as well as on Initial Coin Offerings. Google also provided a full range of crypto-specific terms within its broader ‘bad advertisements’ policy.

(xii) SEC Issues New Operational Guidelines for Crypto Exchanges (March 2018)

As FB, Google continued to ban all crypto-related activities on their respective platforms, the US SEC issued new guidelines asking all crypto exchange platforms to register with the regulatory body to continue with their regular, day-to-day operations. On the 7th of March, the price of a single Bitcoin stood at $8,344.

(xiii) Facebook Enforces Shocking Ban on Crypto Ads (January 2018)

On the last working day of January 2018, the social media juggernaut announced its intention to ban all ads related to cryptocurrency and Initial Coin Offerings from its platform.

(xiv) Coincheck Gets Hacked (January 2018)

One of Japan’s largest crypto exchanges Coincheck fell victim to a group of hackers who were able to walk away with 123 million dollars worth of XRP, and 500 million NEM tokens. The price of Bitcoin lay around $8,800.

(xv) PayPal co-Founder Peter Thiel Acquires Massive Chunk of BTC (January 2018)

Many media outlets reported on the 3rd of January that Venture Capitalist Peter Thiel had bought millions of dollars worth of Bitcoin. At the time, the price of Bitcoin stood at $13,870.

Bitcoin Price in 2017

(xvi) Bitcoin Scales Up to its All-Time High Value (December 2017): $19,893

The 18th of December marked the day when Bitcoin reached its financial apex — a threshold that has since not been broken.

(xvii) CBOE Announces the Launch of Bitcoin Futures Contracts (December 2017)

The second week of December 2017 saw the CBOE launching Bitcoin-based futures contracts. This resulted in the price of the premier asset soaring wildly. Not only that, even the total market cap of the digital currency market as a whole rose sharply around this time.

(xviii) Launch of Segregated Witness Proposal (SegWit2x) Cancelled (November 2017)

Bitcoin’s core dev team announced on the 8th of November 2017, that it was putting its plans of implementing the SegWit2X protocol on the backburner. The price of BTC on the day stood at $7,844

(xix) CME Introduces Bitcoin Futures Contracts into the Market (October 2017)

The Chicago Mercantile Exchange released a circular in which it was brought to the attention of the masses that the financial institution was going to launch a Bitcoin Futures contract by the end of 2017. This was the first time an established financial entity had come forth and shown such explicit support for BTC — mainly because, up until then, BTC was viewed largely as a shady investment tool. Also, in the wake of the above-stated announcement, the price of Bitcoin started to soar and scaled up to a then ATH of touch $6,601.

(xx) Bitcoin Surges Pas $5k Threshold for the First Time (October 2017)

On the 13th of October, Bitcoin, for the first time in its young history, rushed past the $5k mark. This feat was considered quite miraculous by many, especially since the crypto asset had started the year around the $966 mark.

(xxi) China Shuts Down All Crypto Exchanges (September 2017)

After assessing the situation in quite a lot of detail, Chinese tax officials concluded that they would be banning all crypto trade avenues operating within the country’s borders. The announcement immediately caused investors all over the world to panic and sell their BTC holdings — thereby causing the premier digital currency’s value to drop sharply almost overnight.

(xxii) JP Morgan Chase CEO Jamie Dimon Calls Bitcoin a Fraud (September 2017)

Jamie Dimon, the CEO of JP Morgan at the time stated in an interview that he thought of Bitcoin as a ‘fraudulent scheme’ that would eventually cause immense financial stress to a lot of investors. However, the market at large seemed to ignore Dimon’s words since Bitcoin continued to stay strong around the $3,800 region.

(xxiii) Chinese Government Issues Ban on ICOs (September 2017)

During the first week of September (on the 3rd to be exact) the Chinese government implemented an umbrella ban on all ICO related activities.

(xxiv) Bitcoin Undergoes Hard Fork, Bitcoin Cash $BCH Created (August 2017): $3,384

Since the start of 2017, many from within the global crypto community had been asking for a BTC hard fork quite vehemently — primarily because of the scalability issues related to Bitcoin. As a result of the split, the world bore witness to the birth of Bitcoin Cash (BCH).

(xxv) Japan Recognizes Bitcoin as a Legitimate Transaction Medium (April 2017)

The first day of April saw the Japanese government recognize Bitcoin as a legal payment method. News of the announcement sent the price of Bitcoin soaring to a relative high of $1,215.69

(xxvi) SEC Rejects Winklevosses Request for a Bitcoin ETF (March 2017)

The US SEC rejected a Bitcoin ETF proposal submitted to it by the Winklevoss brothers. The reason cited for this refusal was a lack of stability within the crypto market.

(xxvii) Bitcoin Breaks Past $1K Threshold After Nearly Thirty-Six Months (January 2017)

After experiencing a decent rally all through 2016, the price of Bitcoin finally crossed the $1,000 mark after a long long time.

Bitcoin Price in 2016

(xxviii) Bitfinex Gets Hacked, Loses Nearly $72 Million Worth of Crypto (August 2016)

In August, premier cryptocurrency exchange ‘Bitfinex’ announced that it had fallen victim to a cyber scam, which resulted in hackers making their way with a little more than 120,000 BTC. Owing to this massive security lapse, the price of Bitcoin dipped by a whopping 20% almost overnight. In addition to all this, many news reports were claiming that some Bitfinex officials had prior knowledge that this hack was going to take place.

(xxix) Bitcoin Undergoes its Second Halving Event (June 2016)

On the 9th of June, Bitcoin’s block reward quotient was halved once again — thereby reducing mining returns from 25 Bitcoin per block to 12.5.

(xxx) Steam Announces Support for Bitcoin (April 2016)

Gaming platform ‘Steam’ released a statement during the first half of April, announcing its decision to accept BTC as a medium of purchase for its wide array of video game titles and other digital content. This move was quite short-lived because just a few months later, Valve — the parent company behind Steam — rescinded its decision to allow BTC payments.

Bitcoin Price in 2015

(xxxi) Dr. Craig Wright Claims that He is Satoshi Nakamoto (December 2015)

Wired published an in-depth piece on the 8th of December claiming that Australian computer scientist Dr. Craig Wright was the man responsible for creating Bitcoin. The author of the piece, Gwern Branwen, cited a series of emails, deleted blog posts to support his (as well as Wright’s) lofty claims. It was also around this date that Bitcoin’s symbol was officially accepted into the Unicode.

(xxxii) Winklevoss Owned Gemini Exchange Goes Live (October 2015)

Cameron and Tyler Winklevoss came to the forefront when they announced the launch of their very own cryptocurrency trading platform — Gemini. Upon its inception, the exchange was one of the first to base all of its operations in the United States and be fully regulated by local authorities. As things stand, Gemini is operational within 26 states across the US with all of its deposited assets having been insured by the FDIC.

(xxxiii) CTFC Declares Bitcoin to be a Commodity (September 2015)

Despite there being a lot of confusion surrounding the financial status of Bitcoin, on the 18th of September 2015, a representative for the United States’ Commodity Futures Trading Commission (CFTC) announced that the regulatory body would henceforth classify “bitcoin and other virtual currencies as being legitimate financial commodities.”

(xxxiv) New York Introduces a Mandatory BitLicense for Exchanges (June 2015)

On the 3rd of June, the NY Department of Financial Services introduced its very own regulatory scheme known as the ‘BitLicense’. Using this tool, crypto service providers would be allowed to trade digital assets such as BTC, ETH etc. in a completely seamless, hassle-free manner. The price of bitcoin was $232.05.

However, to acquire the aforementioned license, exchanges were required to pay an application fee of $5,000, as well as provide certain biometric data to the FBI.

(xxxv) Coinbase Comes into Existence (January 2015)

Coinbase — currently one of the largest crypto exchanges in the world — came into existence on the 26th of January, 2015. The firm was backed by several venture capital firms and was able to commence its operations across 25 states upon its inception.

(xxxvi) Bitstamp Loses Over 18,000 of its Customers BTC Savings (January 2015)

Using a host of social engineering strategies, hackers were able to steal more than 5.2 million dollars worth of BItcoin from Bitstamp’s coffers. Not only that, the security lapse forced the once premier crypto trading avenue to be shut down for a total of eight days.

Bitcoin Price in 2014

(xxxvii) Microsoft Announces Decision to Accept Bitcoin (December 2014)

Computing giant Microsoft announced back in December 2014 that it was going to start accepting Bitcoin payments from its US customers in exchange for its various digital apps, games and other content (through Windows and XBOX.)

(xxxviii) US Gov. Auctions Off More than 30k Bitcoin (June 2014)

Back in 2013, US regulatory authorities were able to seize a total of 30,000 BTC tokens from individuals who had been indulging in nefarious, silk-road related activities. This handsome sum of crypto was subsequently auctioned off on the 27th of June to the highest bidder — who accidentally turned out to be the billionaire/venture capitalist ‘Tim Draper.

(xxxviii) People’s Bank of China Shuts Down Many Crypto Bank Accounts (April 2014): $501.7

Following a deadline given by the Chinese government to all of the nation’s local crypto exchanges, authorities started to crack down on any trading platforms working in conjunction with local banking institutions.

(xxxix) IRS Announces BTC Will be Subject to Uniform Taxation Laws (March 2014): $453.05

The central tax authority of the USA — the Internal Revenue Service — announced on the 26th of March that Bitcoin would be taxed in pretty much the same way in which real estate is taxed across the country.

(XL) Crypto Exchange Mt. Gox Gets Hacked, Forced to Shut Down (February 2014): $662

On the 7th of February, Mt Gox was subject to a massive DDoS attack that resulted in the firm losing a whopping sum of 744,000 BTC that belonged to its customers. Following this incident, the exchange was forced to shut down on February 24th – with many of the company’s executives facing legal action thereafter.

Bitcoin Price in 2013

(XLI) China Bars Local Financial Institutions From Using Bitcoin (December 2013)

Owing to the rising popularity of Bitcoin within China, the PBOC — People’s Bank of China — took a unilateral step to ban Bitcoin as a medium of exchange within the country’s borders.

(XLII) BTC Surges to a Relative High of $1,242 on Mt Gox (November 2013)

With Chinese investor interest in BTC surging all through 2013, the price of Bitcoin rose to a new high on the 29th of November.

(XLIII) China Legalizes Crypto Trading (November 2013)

The PBOC released a statement on the 18th of November that officially allowed the country’s citizens to “participate in the bitcoin market”. Around the same time, Ross Ulbricht — the person behind Silk Road — was also convicted and sentenced to jail — thereby causing widespread uproar across the globe. As part of the crackdown, US officials were able to seize more than 170,000 BTC.

(XLIV) Department of Homeland Security Issues a Warrant Against Mt. Gox (May 2013)

Officials working for the Department of Homeland Security seized over 3 million dollars from a Wells Fargo Bank account which was linked to the then CEO of Mt. GOX ‘Mark Karpeles’. As part of the investigation, govt officials found Karpeles to be guilty of illegally transmitting money against the banks’ terms of service.

(XLV) Cyprus’ Revolution Causes BTC’s Price to Surge (March 2013): $131.07

After the EU issued a $10 million bailout package for Cyprus (following the nation’s economic struggles) back in 2013, the price of Bitcoin started to surge for the first time in its brief history— with the value of a single token spiking from $80 to over the $260 mark within just a few days time.

Bitcoin Price in 2012

(XLVI) Bitcoin Undergoes its Inaugural Block Halving Event — November 2012

As a result of Bitcoin undergoing its first halving event, the mining rewards associated with the premier cryptocoin dropped from 50 Bitcoin per block down to 25 Bitcoin per block. In addition to all this, content management solution – WordPress – too announced its decision to start accepting BTC for its various internal/external monetary transactions. As per a press release issued by the firm back in 2012, a spokesperson wrote: “Our goal is to enable people, not block them”.

(XLVII) Linode Hack Sees Firm Lose Over 46,000 Bitcoin (March 2012)

On the very first day of March 2012, a hacker breached Linode’s security cover and was able to make his way with more than $228,000 worth of digital assets from the company’s coffers. Some of the prominent people who were affected by this incident included:

- Bitcoin Lead Developer – Gavin Andresen

- Bitcoinica

- Marek ‘Slush’ Palatinus.

Bitcoin Price in 2011

(XLVIII) Mt. Gox Hacked For the First Time (June 2011)

Before falling victim to its now-infamous hacking scandal of 2013, Mt. Gox’s security protocols were also breached a couple of years earlier. According to some reports, the incident saw the once premier trading platform lose a total of 4,019 Bitcoin.

(XLIX) Gawker Publishes an In-Depth Report About Silk Road (June 2011)

Gawker reporter ‘Adrian Chen’ published a piece back in June 2011, in which he clearly outlined how many crypto enthusiasts were making use of a deep web trading portal called Silk Road to facilitate their drug deals. In addition to this, a couple of months earlier, three crypto exchanges (including Britcoin, Bitcoin Protocol, BitMarket) went live – thereby allowing their users to successfully trade BTC in exchange for several different fiat assets. Not only that, around the same time, BTC’s value zipped past that of the US Dollar for the first time.

Bitcoin Price in 2010

(L) Mt. Gox Opens its Doors to the Public (July 2010)

On the 18th of July, Jed McCaleb, the lead developer behind Mt Gox officially released his brainchild for public use. McCaleb was previously known as the person behind a technology called peer to peer (P2P) — which allows users to share data in a completely localized manner. Also, in a matter of 6-8 months, McCaleb ended up selling his baby to Mark Karpeles (on March 6th, 2011), who then went on to turn Mt. Gox one of the biggest crypto entities of that time.

(LI) Bitcoin For Pizza: Laszlo Pays for his Meal Using 10,000 BTC

Laszlo, a BTC enthusiast from the United States, infamously paid for 2 Papa John’s pizzas using Bitcoin (10,000 BTC to be exact). The pizzas were approximately worth 25 dollars at the time.

Similarly, just 5 months earlier, a firm called ‘the New Liberty Standard’ had successfully purchased a total of 5,050 Bitcoin from an individual called Sirius for just 5 dollars.

Bitcoin Price in 2009

(LII) First Official BTC TX Facilitated by Satoshi Nakamoto (January 2009)

The world’s first Bitcoin transaction took place on the 19th of January between Satoshi Nakamoto and his tech associate Hal Finney. The tx saw a total sum of 10 BTC being exchanged between the two individuals.

(LIII) Genesis Block Established (January 3rd, 2009: $0)

On the 3rd of January, 2009 the world finally bore witness to the birth of Bitcoin — as Satoshi Nakamoto mined the premier currency’s first block ( now known fittingly as the Genesis block.)

There you have it bitcoiners. The future forecasts and historical bitcoin price timeline, laid out all right in front of you. Now, it’s time for the last two notches on the belt and that is to discuss the economic factors that influence the price of bitcoin (supply/demand) and top 50 Bitcoin catalysts for the BTC/USD price to turn bullish again. From the mining halving, institutional interest and decentralized financel/global banking, here are a few key compontents to keep a pulse on in the next few months and years.

Understanding Economic Factors Causing Bitcoin’s Price Fluctuations

Traders and economists around the world at multiple skill levels have been trying to predict the price of Bitcoin through the years, ever since the industry started. Even with many different methods of analysis, Bitcoin has continued to be a controversial and highly risky investment, and the rest of the cryptocurrencies typically follow the same pattern.

Many different factors come in with price oscillation of Bitcoin in different periods, and some of these factors remain unknown at this point. By understanding the fundamental variables that determine where Bitcoin’s price lands, investors have the upper hand in the future.

The Volatility of Bitcoin

One of the most common words that arise concerning Bitcoin is volatility. Volatility, at least in the economic sector, shows the intensity of changes over a given period for a security. As a financial asset is more volatile, the price can change at a faster and more significant pace.

Bitcoin reached $6,300 on November 15th, 2018, and the price fell to $3,700 within ten days, which is a decline of 40%. This kind of drop for a traditional asset would be historical, but it has become relatively typical for Bitcoin. While it is typical to connect the volatility of an asset to the risk associated with it, the connection isn’t wrong exactly. However, since it focuses exclusively on the negative impact of volatility, it isn’t a complete perspective.

Taking ownership of a large amount of any volatile security exposes the investor to the possible price fluctuations that come with it, impacting their financial portfolio. Over time, holding onto it could bring some unpleasant trends, and the propensity for risk is necessary to understand. On the other hand, having highly volatile security could come with massive rewards, if the trader has the knowledge to follow the events that made a difference. Price increases happen quickly, which means that traders can take hefty profits upon closing positions if they made the correct predictions.

Throughout the lifetime of Bitcoin, Bitcoin has continually been highly volatile, which is mostly because the value relies on the speculation over the future potential of the security. Bitcoin’s oscillations make a lot more sense with understanding the events that have impacted the asset previously.

Brief History of Events That Have Influenced Bitcoin

Reviewing the bitcoin price history timeline is only part of the story. Bitcoin was born as a solution and an answer to the financial crisis, launching in 2009. Still, very few people believed that it would end up reaching the heights that it has so far. In the beginning, only a select few even knew of its existence, and the value of Bitcoin was only $0.0001. In the last decade, Bitcoin has even gone as high as $20,000, which means that it has had the best performance of any asset during the past decade.

Bitcoin didn’t start getting a ton of attention until 2013, coinciding with the drama surrounding the Cyprus bank. In November, Chinese investors decided to make a big Bitcoin purchase, which made the price rise by over 1,000%. Unfortunately, this forward momentum didn’t last.

Within a few months, in February 2014, Mt. Gox faced a massive DDoS attack. Since approximately 70% of the trades involving Bitcoin were handled by the company at the time, this attack put a massive damper on the price. Bitcoin and altcoins alike were hit hard, facing a drop of about 40% and the start of a long bear market.

Next, by late 2016, Bitcoin started to experience a steady climb in price, which ended up continuing into 2017. The cryptocurrency market was flooded with billions of dollars, but the big showstopper of 2017 was the influx of initial coin offers. It seemed like the public didn’t care about qualifications or any proof of profit by blockchain startups, because everyone wanted to be a part of the craze.

Unfortunately, the hype didn’t hold up. Scalability problems with Bitcoin arose, which means that the transaction fees and wait times jumped with the price. While Bitcoin ended up reaching just under $20,000, a crash sent the market tumbling down fast, dropping to a low of $4,000. Bitcoin was hit hard, but the rest of the market was hit even higher. Most ICOs ended up dead in the water within a few months.

Knowing and understanding these events in the price history of Bitcoin is key, as they ultimately impact the price of Bitcoin in a major way. Still, the biggest influence is the economic forces in the background.

Beneath the Surface of Bitcoin’s Market

Bitcoin’s price heavily includes volatility and major news events as part of its narrative, but they are indirect influences. Most of the time, the actual mechanisms behind the value of Bitcoin aren’t discussed, but they are important to understand. Ultimately, it all comes down to supply and demand.

This fundamental economic principle states that the value associated with any good or service comes from two factors – how much exists (supply) and how much people want/need (demand). The price goes up when the demand is greater than the supply, and it drops when the supply is more than the demand. When the principle is applied to goods and services, it makes sense. However, it’s a bit harder to understand with Bitcoin.

Supply and Demand with Bitcoin

In most situations involving supply and demand, goods and services are paid for with currency. However, when currency is the only commodity involved in a transfer, which is what’s involved with Bitcoin, things are a little different. Supply and demand still apply, but the conversation is about two different currencies, i.e. Bitcoin and US dollars.

While the seller of BTC for USD is on one side of the market, the other side involves the individuals that are trying to use USD to purchase BTC. The “price” for that moment is the dollar amount that buyers and sellers settle on for each other’s offers. Ultimately, this arrangement means that the volume of sell orders in conjunction with the buy orders is the equation that matters. Increasing supply is connected to greater sell volume, though the price decreases with constant demand.

Breaking it down simply, Bitcoin’s future price can be predicted with the factors that influence supply and demand. While it is impossible to understand this circumstance perfectly, there is plenty that traders can do to at least understand it better. It is possible to achieve perfect knowledge of supply, but that’s a matter that will be dealt with later in this discussion.

For demand, the key contributing points include:

- BTC’s price

- The price of complementary and substitute goods

- Consumer income and purchasing power

- Subjective expectations of consumers

- Elasticity of the supply

- Consumer needs and desires

As the price of a good or service increases, the demand decreases, making the correlation between quantity and price inverse. When demand is more positive for assets, the assets are referred to as Giffen goods. While it might look like Bitcoin is one of those rare circumstances, since the demand may increase for Bitcoin when the price starts to move upwards, there’s a major piece of information missing.

The available supply and total supply of Bitcoin are two different things, and both of them are contributing factors in the price of Bitcoin.

Scarcity – Bitcoin’s Limited Supply

Everyone has access to the knowledge of the total supply of Bitcoin, and anyone can go on the blockchain to see how many BTC are in circulation at this exact moment in time. It is also public knowledge that the total supply of Bitcoin will be 21 million BTC, which is programmed into the protocol of the asset. Likely this number will never change since that would basically destroy the main value proposition of Bitcoin.

Bitcoin was developed to have something that no national currency has – unforgeable scarcity. Governments around the world have the ability to increase their fiat currency’s supply at any time, but the same power is not available to anyone with Bitcoin. The Bitcoin protocol has predetermined the number of coins to ever be “minted.” While adding coins to the supply via mining is possible, it won’t ever exceed the number of coins originally determined.

The number of coins that will enter the Bitcoin market is predictable and transparent, which means that the supply isn’t elastic. The price of Bitcoin is volatile for exactly this reason since the demand has no influence on the supply. Typically, goods and services don’t function in this way in the economy, but there’s a version of supply for Bitcoin that is involved in the market that makes its circumstances unique.

Available Supply and Bitcoin’s Price

The last piece of the economic puzzle of Bitcoin is the available supply. Available supply typically is a reference to the volume of BTC that individuals are willing to sell off at any price. Available supply is not the same as circulating supply, as the latter is the amount of BTC that has already been mined, but they cannot be purchased.

Ultimately, it comes down to simple math: Available supply = Circulating supply – BTC that are being held or are lost.

Let’s say there’s 18 million BTC in the circulating supply. Assuming that two million BTC have been lost over time with a forgotten password, hard drives, and other issues, there would be 16 million BTC left. The owners that hold 15.999 million of that BTC would most likely not sell below $10,000. The most available supply at any price below $10,000 would not exceed 1,000 BTC. If buyers were willing to purchase 2,000 BTC without price being a factor, what could happen?

Firstly, the available 1,000 BTC would sell for somewhere under $10,000. However, the number of willing sellers would decline, and the price that the buyers would be willing to cover would steadily increase still, representing demand. Buyers would end up pushing the price over $10,000 each when more sellers (supply) become willing to part with the asset.

If at any point, the sell volume is higher than the buy volume, the price will drop. If the reverse is true, then the price will start to rise. Volatility can decrease over time, but the changes between buy and sell volumes will continue endlessly.

The Differences Between Speculation and Intrinsic Value

Humans are responsible for assigning intrinsic value to an asset, based on the cost of production, functions, and scarcity. With fiat currency, the value is based on their use and social contract as the main currencies in their economies. However, Bitcoin has no association with any government or other institutions and is instead a currency of the internet. How it is possible for Bitcoin to have true intrinsic value as a currency?

Before getting into that concern, let’s break down the three basic functions of any currency –

- Means of exchange.

- Store of value.

- Unit of measurement.

Identifying the intrinsic value of cryptocurrencies is a little different since detractors assign Bitcoin value of zero in this scenario. The value is due to the fact that the virtual currency isn’t linked to a tangible asset, local economy, or government.

Still, that doesn’t mean that Bitcoin doesn’t possess the same three functions.

As a means of exchange: Businesses around the world accept Bitcoin and cryptocurrency as payment, but this acceptance is still few and far between. Bitcoin’s mass adoption depends on their solutions to the scalability issues that it has faced for years, which is being corrected through multiple upgrades and innovations.

As a store of value: Even though Bitcoin’s unpredictable and volatile nature of the present makes for a difficult argument in favor of being a store of value, that won’t necessarily influence the future. In fact, it could end up being the best store of value ever had, since the decentralized nature makes it possible for anyone to access Bitcoin. When it comes to transferring wealth especially, the digital currency is still attractive.

As a unit of measurement: The only way to be used as a unit of measurement is to have stability. Unfortunately, Bitcoin presently lacks this quality.

How strong currency increases with continual use. Becoming a strong store of value comes with increasing the individuals that are willing to trust it. Luckily, as the tech improves and the market adds new investors, Bitcoin’s intrinsic value will increase with time, but the likelihood of this actually happening could be anyone’s guess.

Based on the history of every new currency through the years, the ones that used the currency first were the ones who had the greatest gains when the rest of the local economies caught on. If a trader believes in Bitcoin’s chance of being adopted at a mass scale, purchasing some to remove it from the available supply may be the right step towards being involved in its progress.

Top 50 Bitcoin Price Prediction Catalysts on the Horizon

The bitcoin halving is happening but there are numerous other crypto catalysts entering the conversation.

Even though Bitcoin, along with the whole cryptocurrency market, is going through a stalling phase after a pleasant resurgence over the last few months, there is still good news yet to come for the market.

During the course of the Baltic Honeybadger conference, the head of investments during the crypto hedge fund – Adaptive Capital – Murad Mahmudov took the time to provide insight into the kind of catalysts that Bitcoin has to look forward to.

So how many ‘catalysts’ does the cryptocurrency have ahead of it? An impressive amount to be thoroughly clear – more than 50 to be exact – and each of these have the potential to provide some serious wind in the metaphorical sails of Bitcoin when it comes to vital segments like growth, adoption, application and, more importantly for investors. Each of these could help boost the appreciation of its price towards the end of 2019 and into 2020 and beyond.

During this conference, Mahmudov argued that, while there are some pretty impressive winds blowing in favour of Bitcoin in the future, there are some big factors in the present day that are helping it in the present. Some of these include the profound and deteriorating level of trust in the relationship between the people and political and business organs such as the government, the media and companies.

This brittle relationship between the people and the ‘mainstream’ political and business world is juxtaposed with the growing power, influence and efficiency of Bitcoin and its network. In addition to this growth, there is a greater desire from the public to improve their literacy and personal use of BTC.